When I was an undergrad I had a strategy professor who desperately tried to drive into my skull that cutting costs was never enough for a company to succeed; the first priority should be increasing revenue. This made sense but went against my instincts as everything in the supply-chain world was about cutting costs and increasing efficiency.

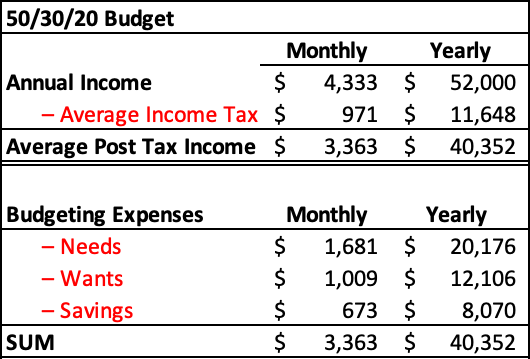

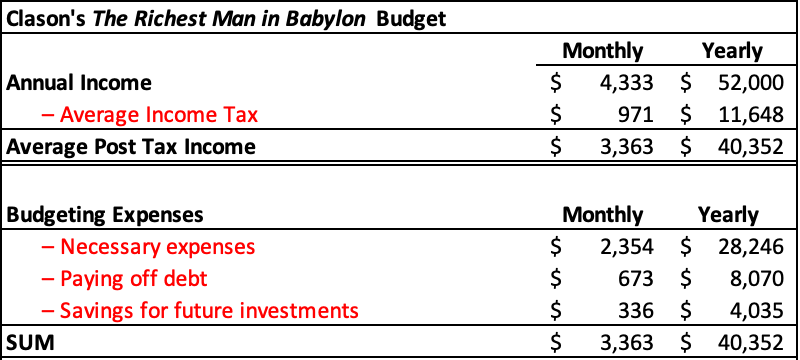

This is an essential concept in personal finance as well. Yes, we should be saving 50% of our income, but we won’t see any progress until we start to actively attempt to increase our salaries.

How to Increase Your Salary

Maybe the quickest way to increase your salary is to get a new job. It’s well known that job switchers receive pay increases that they simply would not have if they stayed at their current company. For whatever reason, loyalty to companies is not rewarded monetarily, never forget to look out for yourself!

If you want to stay at your current company look into educational opportunities that your company supports. It can be a master’s degree or certification. This can look different depending on your role and industry. Examples can include a 6 Sigma Blackbelt certification, or CFA/CPA designation. Master’s degree content can vary widely but almost always puts you in a position for an increase in responsibility, and therefore pay.

Pick up a side gig – some are easier to start immediately making money (think Uber and Lyft). Others like blogging take a lot of time usually without immediate results. That’s why driving for a ridesharing service is so popular there’s basically a guarantee that you will immediately start making money! Whatever you enjoy doing see if you can monetize that, streaming on platforms such as Twitch is incredibly popular. If you’re already gaming why not stream and try to monetize that?

It’s Not Easy

One reason increasing your salary isn’t talked about in personal finance circles is because it is hard. It takes a lot of effort, and you don’t see the payoff immediately. We can make instant impacts on our personal cash flow with budgeting and saving but most of us will be working the same job we’re in for probably another 2-3 years.

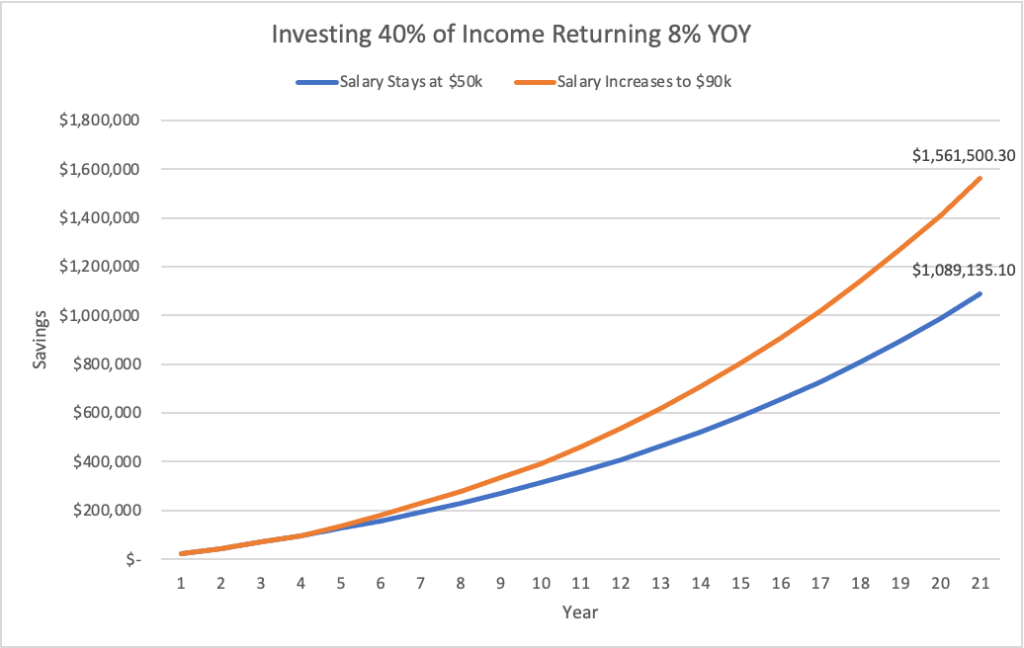

Here’s a way to visualize the difference between staying in one job and consistently investing assuming an average 8% rate of return on your investments. For simplicity’s sake, we’re not taking into account any investments that require larger capital outlays such as real estate purchases.

The person who consistently saves 40% of their $50,000 income could expect to have $1.09 million dollars after 21 years, that’s awesome! But take a look at the person who aims to increase their salary. They keep investing 40% of their salary but eventually reach a $90,000 income. They should end up with around $1.56 million dollars in invested savings. We’re talking about a difference of almost $470,000! With inflation currently around 9% in the USA, it’s probable to say $1 million won’t have the same purchasing power in 21 years as it does today. Every extra dollar earned and invested will help!

Drake is a freelance writer who’s interested in history, economics, art, & beer. He writes about popular personal finance topics and shares his personal finance experiences Make sure to check out more posts on Abnormal Money.