I’m a person who always has big plans but has trouble following through. When I was a kid playing chess I’d have great opening moves but I would never close the game. Understanding your tendencies and weaknesses is essential to put yourself on the correct path to achieving your goal.

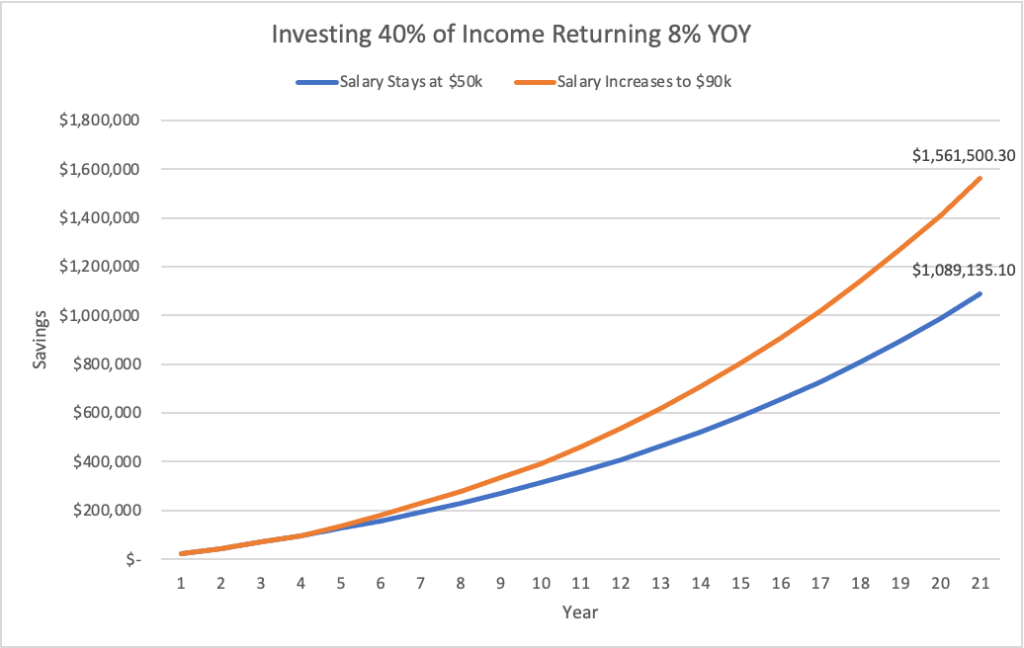

Most of us are not great at long-term planning, but that’s the key to success. Planning and investing for the long term helped Warren Buffett accumulate his fortune. It’s helpful to have guidelines for your investment and career strategies so you stick to them.

Develop A Framework For Your Goal

Specificity

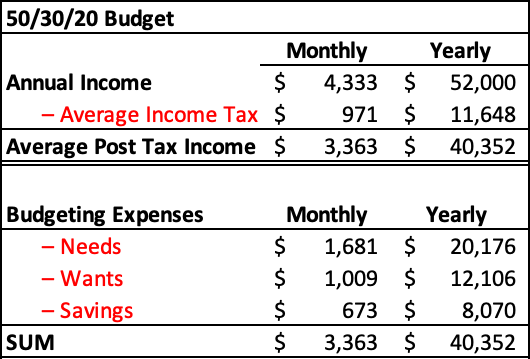

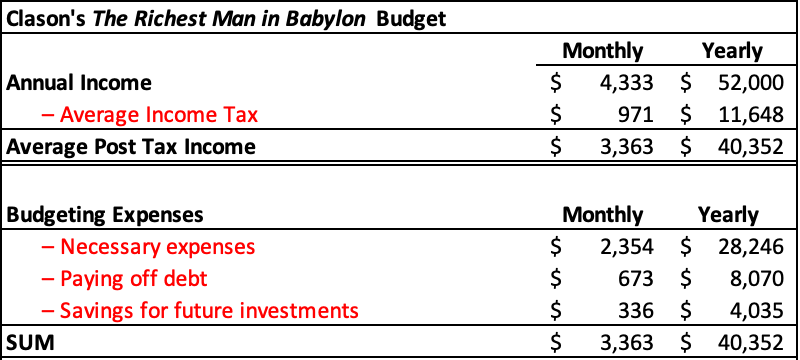

Specificity should be front and center when thinking about career & investing. Usually, those goals are monetary. If you have a goal to live a certain lifestyle, what amount of capital do you need to acquire to live that way?

Setting a specific dollar amount is a great goal because it is clearly articulated and measured. It doesn’t do much good to say, “I want to be rich” or “I want to be financially independent”. If you have a number you can work toward, that makes the journey much more realistic.

Time Constraints

If you never set a date at which you’d like to achieve your goal it’s doubtful that you’ll ever achieve it. Specificity combined with a time constraint allows you to break up your goal into manageable chunks.

Think of a longer time horizon, and set your goals to be big. Then start to break them into yearly goals. It’s better to dream big and fall short than be too conservative. Our world rewards risk takers and dreamers.

The End Goal

It’s important to have a purpose in mind for saving and investing. A lifestyle you want to live, the flexibility to take a job you actually want, the ability to pay for your children’s education, whatever it is find something that motivates you.

For myself, I want to be able to do whatever I want to do without fear of ever “needing” a job. I never want to be in a position where I’m forced to stay in a job that I’d like to leave. Hoarding capital allows you the ultimate freedom to do as you desire.

Take a couple of minutes to listen to Buffett, I think it’s important to not be taken away by excess.

Here’s an example of some possible goal setting for an ambitious investor:

Goals:

Net Worth $1,000,000 by December 1, 2035

Save $75,000 for graduate school by February 1, 2025

Earn $100,000 yearly income by December 1, 2029

Be Self Employed by December 1, 2035

It could be easier to substitute years for your age, but any way you tweak these basic goals should help you out.

Drake is a freelance writer who’s interested in history, economics, art, & beer. Drake graduated with a degree in Supply Chain Management and began working at General Motors. He writes about popular personal finance topics and shares his journey. Make sure to check back for more posts on Abnormal Money.