I started my career in supply chain after graduating in May 2021 with a bachelor’s degree in Supply Chain Management from a state school. When I first got to college I only vaguely understood what my major was. When I graduated supply chain news dominated major news networks.

I’ve been working in the auto industry for a year and moved away from my home state to the midwest. In all honesty, have been working my ass off. After one year I thought it would be relevant to reflect on my time so far and the lessons I’ve learned since joining the professional world.

Make Saving Intentional

Having a salary and a bit of disposable income was a little frightening at first. After using a budget to purchase some essentials (lease for an apartment, furniture, dishes etc.) I was suddenly left with a respectable inflow of cash into my bank account. I lived with my parents for a couple of months after graduating and worked remotely so I was able to save up but more importantly, see how others were spending their money.

Some people I saw were spending with what I thought was reckless abandon. Really nice apartments in new cities, shopping sprees, jetting off on vacations, really celebrating graduating and a new job. Good! Graduating and getting a good job is deserving of celebrating. I myself am 50/50 in terms of financial behavior. I am 50% frugal from my dad, and 50% prone to spending from my mom.

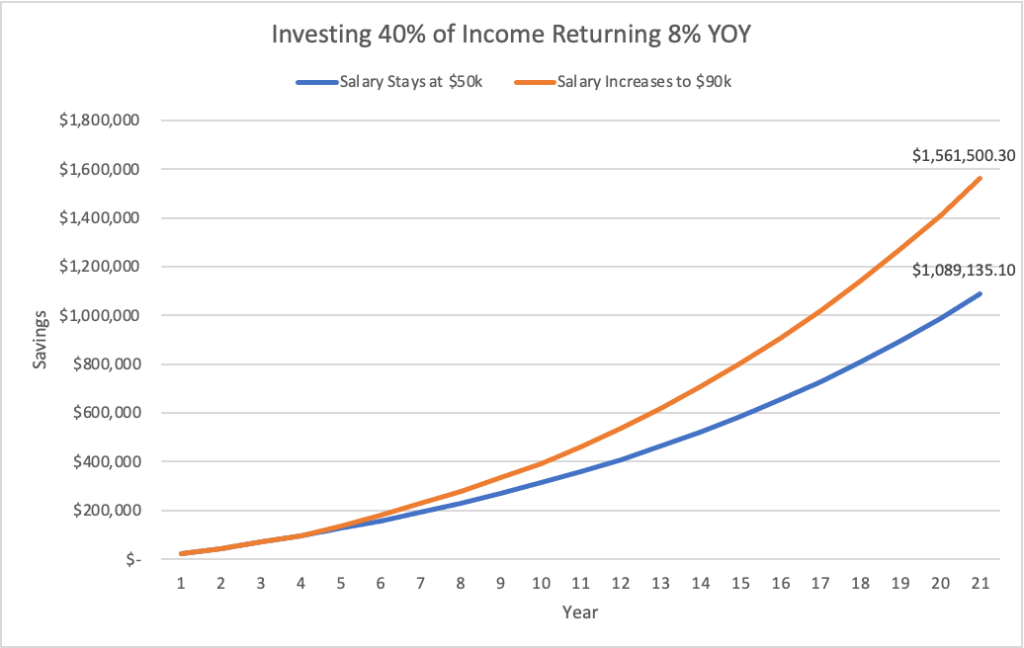

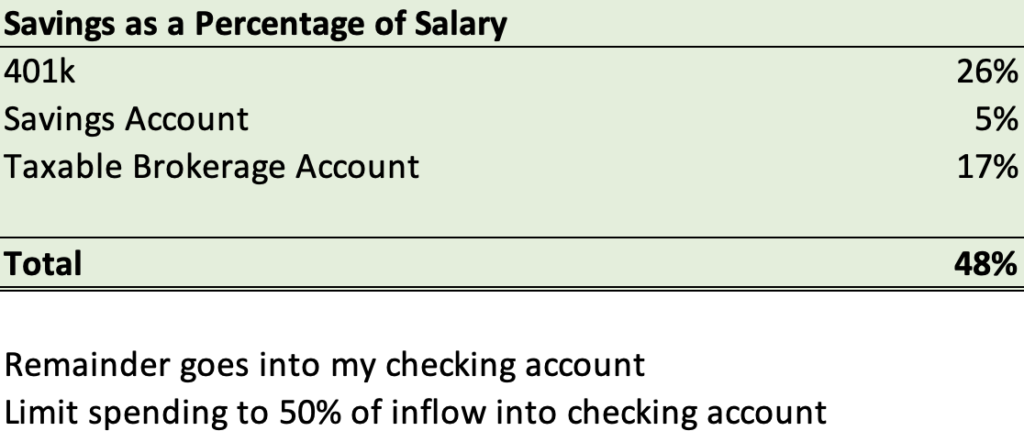

That’s why I knew I needed to just go ahead and save some amount of my gross salary and then spend the rest weekly within reason. I’ve read lots of personal finance blogs, and books, and talked with my dad so after twiddling around with my allocation I’ve settled on the following.

48% seems like a lot of your gross salary to save and it is! That’s why I just go ahead and have these percentages moved into the appropriating brokerage and savings accounts before I even touch the money. I pay myself first and then live within my means for the rest.

I recommend saving at least 50% of your income as a goal, it’s tough but in the end, it will be worth it.

Investing Is A Waiting Game

When I started contributing to my 401k the markets were at near highs. Within a couple of months inflation had skyrocketed, Russia invaded Ukraine, and the markets took a nose dive. I was aware of the fact I was getting in at the top and therefore knew that I would be in for some pain in the short term.

The S&P 500 is down almost 20% in the last two years. It hurts to consistently contribute money to my accounts as the market keeps plunging. I recently increased my 401k contribution while the market continued to have one of its worst first halves of the year in recent memory. I’ve been reassured by Benjamin Graham’s story of Mr. Market. The market operates on emotion and there is plenty of reason for the world’s investors to be pessimistic due to world affairs.

Right now it’s painful to invest, but the history of stock markets, says that it will be worth it in the end. That’s not to say the status quo cannot change. In the meantime, I’ll be periodically reviewing my investment decisions.

My Career Consumes Most Of My Day

To be completely honest I severely underestimated how much time I would have to devote to my job to excel. I’m more or less available between 5:30 AM and 6:00 PM every day. Occasionally I have to work weekends as well. Add that to the social hours to meet colleagues and I’m exhausted at the end of the day. That’s part of the reason I stopped writing for this blog, the shock was a little too much for me to handle.

The supply chain doesn’t sleep, especially for manufacturing firms. The sheer amount of invested capital necessary to produce millions of products every year necessitates those same machines running for as much time as possible. The result is they need a constant stream of components to assemble essentially 24/7. In the corporate sense you never really leave work at work although I’ve gotten a little better at ensuring work-life balance.

Supply Chain Has Turned The World Upside Down

Now more than ever the general public is aware of the supply chain for their products. More often than not they are blaming it either for its price or the product’s lack of availability. This level of visibility is driving companies to really take a look at their supply chain and decide if it can be improved.

I’m relatively comfortable with my career choice because of this, I expect supply chain professionals to be in demand for quite a while. One day I might want to experience a different role and different function, but I have no qualms about contributing to improving supply chains for the foreseeable future.

If you can choose a career that you enjoy AND is in demand. That is key to securing a healthy income and enjoying your job as much as you can.

Understanding Your Job’s Financial Implication Sets You Apart In Your Career

Many professionals in the supply chain are incredibly good at their job. The meat and potatoes of the supply chain. Monitoring inventory levels, working with external parties such as carriers and suppliers, production scheduling, etc. I’ve noticed a common theme among those I’ve seen be promoted and people already in positions of leadership.

They are all able to explain supply chain implications in regard to the company’s bottom line. Being financially literate is key to assuming more responsibility at your company and in turn, growing your salary.

All in all, one year in has been tough but rewarding. I’m excited for year two!