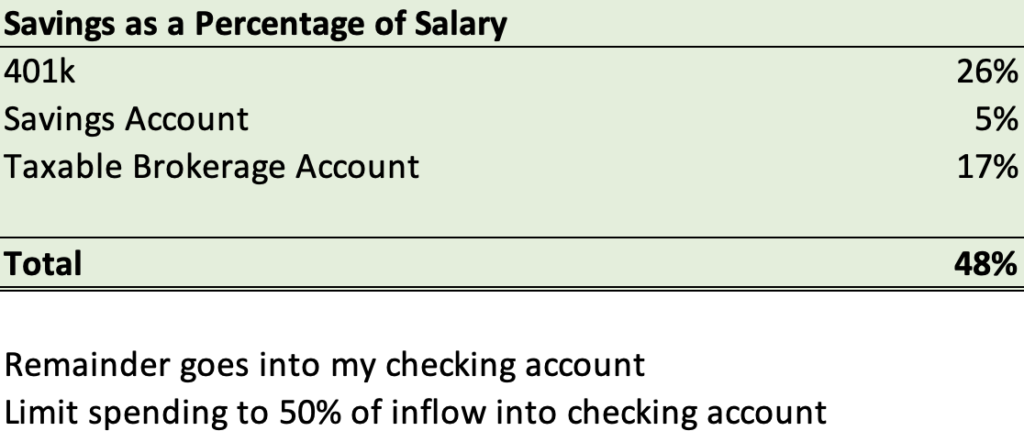

I tend to agree with the notion you should save around 50% of your income. I’m not entirely convinced on what percentage of that we should be saving pre-tax and how much we should be saving post-tax.

It largely depends on your age and future plans. I’ve been thinking about some guidelines to determine what percentage of your 50% savings rate you should allocate pre-tax versus post-tax.

Goals Determine How You Save

Think about your goals in the next 10 years, if you decide to either buy a house or go to graduate school I urge you to reconsider your pre-tax savings rate.

Let me give you an example. Until recently I was saving 30% of my gross income and putting it towards my 401(k). This reduces the amount of taxes I paid in total, but considerably reduced my take-home pay. The only downside to investing in a 401(k) is you cannot withdraw from it without penalty until you’re 59 1/2.

Save for Graduate School

If you’re attending non-sponsored graduate school within the next 5-7 years I would keep your pre-tax savings to under 20%. I personally think any chance to reduce debt is worth it. I already know the argument is that you can earn high returns investing that money and just take on relatively “cheap” debt to maximize your potential wealth.

I value the freedom that comes with living with no debt more than I do excess returns. It is such a relief working every day and saving for retirement knowing that you are not a slave to debt. Sure you have to work to provide for yourself and your family if you have one, but that is entirely under your control.

If you attend graduate school full time you have to consider living expenses while not earning an income. Saving 50% per year should equate to a year’s worth of living expenses. Of course, that 50% savings will not be liquid if any portion of it is saved in a 401(k) or Roth IRA.

Let’s say you save 25% of your income in a 401(k) and Roth IRA. That leaves you with 25% to save that is liquid. This is the amount that you can plan on using when you attend graduate school. The savings rate is every year you save 25% you save 6 months of expenses.

For simplicity’s sake let’s say the location of your graduate school has a comparable cost of living to where you currently live. For a full-time 2-year MBA program you should save enough for living expenses in 4 years.

For a full-time 3-year law program you should have enough living expenses saved after 6 years.

If you can swing a sponsored full-time or part-time program you’ll be even better off!

Save for a House

A common goal for many is to own a home around the time they’re 30. If you’re saving towards this goal you want to make sure the savings you have are liquid and easily accessible. We can do the same exercise as above, except using time as a measurement of living expenses isn’t really relevant.

You want to save up a large enough down payment, typically 30% of the purchase price.

Determine what your goals are before maxing out your 401(k), it might not be the best move for you.

Downside To Saving Cash

One of the main drawbacks to keeping a lot of cash is inflationary pressure. In our current environment (around 9.1% inflation), if you’re not growing your cash it’s lost 9% of its value in the last 12 months.

So the cost of liquidity is essentially the rate of inflation plus the performance of whatever you would have invested that money in, let’s say the S&P 500 index to keep it simple.

So we’re looking at inflation of 9% for the past 12 months and the market is down around 8%. So we would have been better off not investing in the past 12 months but remember that no one can predict the market.

The market has averaged a positive 10% return since 1957, this just happens to be a down year.

Make sure you understand the opportunity cost of holding savings in cash reserves. Sometimes it’s worth it to bet on yourself by investing in education. Sometimes you need liquidity to invest in another asset class.

Don’t underestimate increasing your earning potential. Aggressively saving is not enough.

Cash is King?

I think we tend to underestimate the power of liquidity. Having cash ready to deploy in assets that have been dragged down by the market is a powerful force. So is the ability to invest in yourself to improve earning potential and career prospects.

Think twice before you have all of your cash tied up in ill-liquid holdings.

What level of liquidity are you comfortable with? Let me know what you think.