Investing in real estate property so I can start house hacking is my #1 goal in the medium term.

I’ve already written on how expensive rent is and listed ideas to offset high rent.

But I don’t like paying rent at all! In fact the sooner I can be in a position where I don’t pay rent, the better.

That’s why my immediate medium-term goal is to invest in a piece of property that I can live in and rent out the additional space I don’t use.

I could do this with a house, but I really don’t want to bother living with roommates. They’re bad enough as roommates so I can’t imagine having to deal with them as a tenant.

That’s why most of the properties I’m interested in are multi-family units.

Think duplexes or condos.

That way it’s possible to live in one unit and rent out the other to a prospective tenant.

If I plan it right the rent from one unit could pay my mortgage & utilities! Let’s look at example.

How Does House Hacking Work?

Usually when you buy an investment property you have to put 20% down to avoid expensive mortgage insurance and to qualify for a loan.

Sometimes the minimum can even jump to 25% when purchasing a real estate investment property.

That rule doesn’t apply to house hacking, because your investment property is also your primary residence.

This means you can qualify for a loan with much less that 20% down because you are buying your primary residence.

Think about how much that changes the investment strategy now. Let’s say the properties I was looking at investing in were between $300,00 – $400,000.

That would usually mean a 20% downpayment would require $60,000 – $80,000. There are several federal programs for 1st time home buyers where you can qualify with as little as 3% down.

That means you can qualify for loans with between $9,000 – $12,000. That’s a much more attainable downpayment.

It’s important to note that you still have to pay for the mortgage insurance if you put down less than 20%.

Another disadvantage of putting less money down is that your monthly payments will be higher.

The key here is to make sure that the rent you can charge on the other unit(s) is equal to or greater than your payment. This is usually easier when your multi-family property has three or more units.

I think a duplex is a great starting point for house hacking. They’re cheaper than larger units and you can pay a little more and get a pretty nice duplex to live in.

Choosing A Mortgage Loan for Your Property

There are three common lengths of mortgages when purchasing real estate. 30 years, 20 years, and 15 years. The longer the mortgage the lower the monthly payments will be.

The only problem is you end up paying more in interest over the life of your loan.

There are more complicated loans than the three I’ll talk about here like the 7/1 ARM loan.

For now I’m going to focus on three simple loans that make it easy to understand the benefit of buying multi-family real estate for your primary residence while renting out the other units.

I’ll demonstrate the 30-year mortgage in detail and then compile the rest of the information in a comprehensive table.

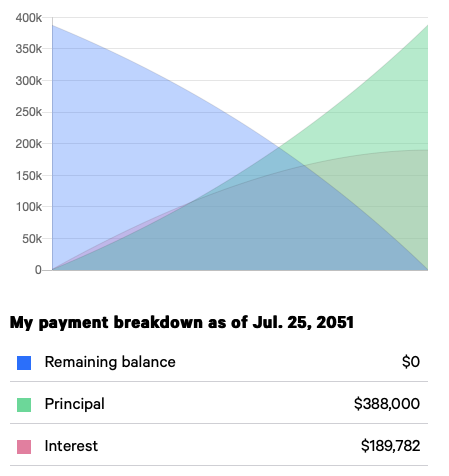

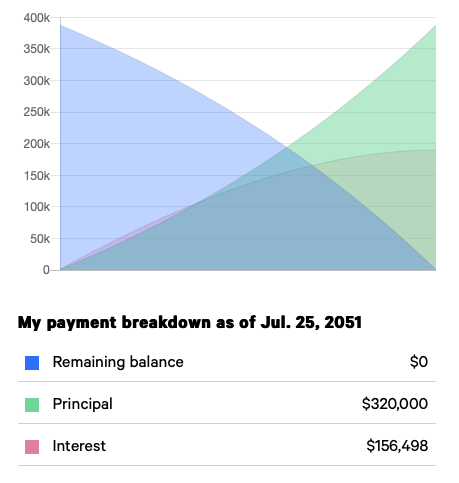

I’ll reference graphics from bankrate that illustrates how much you’ll pay in interest for the three loan types.

30-Year Fixed Mortgage

All of these mortgages we are considering should be fixed, which means you lock in the current interest rate for the length of the loan.

This is a no-brainer because right now most rates are just under 3% which is dirt cheap.

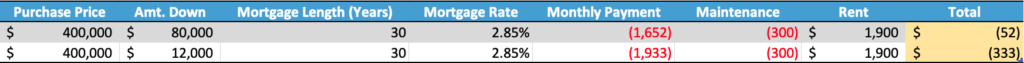

If your target property is $400,000 here is what your cash flow could look like with 20% down or 3% down.

I’m assuming this $400,000 property is a duplex with each unit having two bedrooms and one bathroom.

The monthly payments are not outrageous, those would be pretty common rents for a two bedroom and one bath apartment. The Maintenance costs included cover any repairs you might have to make as the landlord.

Living in one unit and renting the other out for $1,900/month would leave you with a $52 payment to cover the mortgage if you put 20% down, and $333 to pay if you put 3% down.

This is where the magic starts to happen.

That amount you pay is basically your rent.

I don’t know anywhere in a large metro area where you can rent a two bedroom unit for that amount with NO roommates!

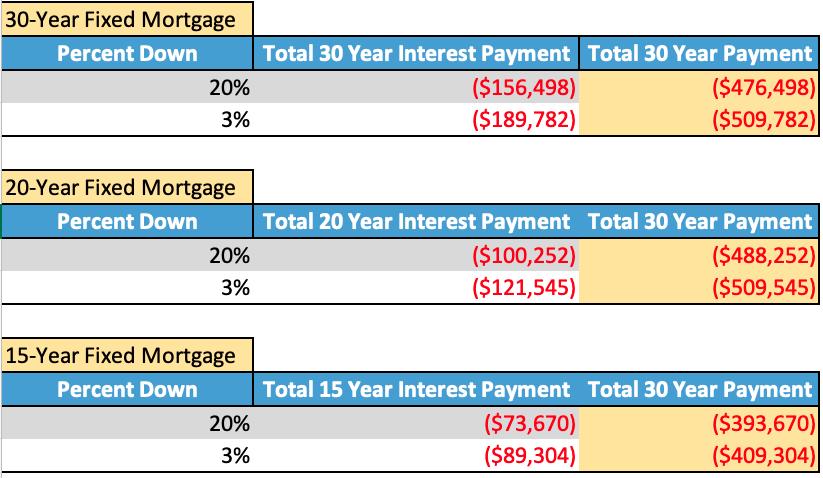

Let’s see how much you pay in interest over 30 years with 3% down:

After 30 years you’ll have paid $388,000 in principle and $190,000 in interest. That brings the total amount paid for a $400,000 property to roughly $578,000.

Essentially you pay a premium of $178,000 over 30 years because you don’t have buy the property for full price.

Compared to the loan payment with 20% down:

You already see that you pay less interest over 30 years, because you’re not borrowing as much money. You pay a total of roughly $476,000 in total on a $400,000 property.

This is a much more attractive payment plan than financing with only 3% down. The downside is of course that it requires more initial capital.

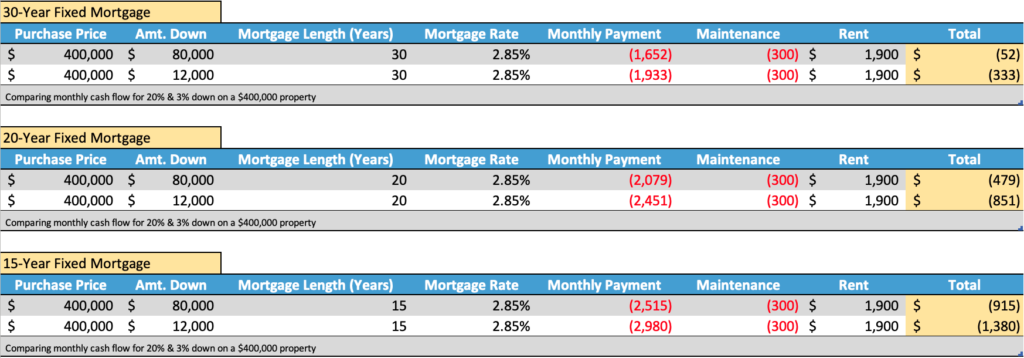

To save you the time of looking through two more sections of this, check out this compiled table below.

Compiled Mortgage Payment Tables

Here is what your cash flow would look like for each mortgage scenario. This also takes into account if you would rather put 20% down or 3% down.

The highest monthly payment you could have is in a 15-year mortgage with 3% down.

$1,380/month is equal to rent for a nice one bedroom unit in my area so that’s a good deal.

However, it’s not really the best because we want to lower our living expenses with house hacking.

This makes the 20-year mortgages look like the best deal, especially if you can put 20% down.

Before we come to any conclusions we should compare the total amount paid for each loan, especially looking at interest.

Knowing that monthly payments are cheaper with longer loans, you might be tempted to opt for the longest loan.

But looking at the above table, you see you’ll actually pay the most in interest with a 30 year loan and 3% down.

It comes as no surprise that the cheapest loan is the one for the shortest amount of time and the most money down.

Keep your total costs in mind when financing your property. I am fairly debt-adverse so I feel more comfortable with the idea of a 20 or 15 year loan.

Paying Off Debt With Inflated Dollars

Although you might argue if you want to never sell income producing properties why does it matter how long your loan is?

That additional capital could be better spent working for you in your 401(k) or post-tax investment accounts instead of paying off your mortgage.

There’s one more aspect that I have to mention before talking about taxes.

Remember when I said that it’s important all of these loans are fixed?

That’s because not only do you lock in historically low interest rates for the duration of the loan, but you are paying down your debt with inflated dollars.

Think about it this way, when you lock a loan in, you guarantee that all of the loan fees and interest you pay are on present dollars.

So if you take out a mortgage tomorrow and lock in the rate, that’s a rate and a repayment schedule of 2021 dollars.

In ten or twenty years your salary could have increased 2-3% per because of inflation.

So whereas you were paying off your debt with a salary of $100,000 in 2021, in 2031 you’re now paying off the same debt with a salary of roughly $135,000.

That’s not even accounting for all the raises you’ll receive over ten years!

Essentially you’ll have more money to pay off your debt thanks to inflation.

Paying yesterdays debt with todays dollars is almost always a good idea, because inflation is trending up.

All of the benefits I’ve mentioned so far only get better and more pronounced if you buy larger properties with more units.

It all depends on the area you live in and the prices, but you can conceivably turn a profit if you purchase a quadplex instead of a duplex.

Inflation Impacts Your Property Value

Using the same rate of inflation of 3% for home prices (although in 2021 home prices have increased much more than 3%) we can see the value of your property in 10 years.

The $400,000 property you purchase today will be worth almost $538,000 in 10 years.

After 10 years with a 20-Year fixed loan and 20% down you’ve paid off roughly $140,000 in principle and have roughly $178,000 in principle left to pay down.

So you’ll have $360,000 in equity after 10 years, and you’ve been paying $479/month towards the mortgage.

This is basically magic, and I’m not even including rent increases due to inflation!

Now you can see why investing in real estate is so popular for the wealthy, if you buy smart you’re almost guaranteed to make money in the long term.

Tax Benefits

When you invest in real estate you get access to certain tax privileges.

Some of the most attractive deductions include the ability to deduct property taxes and the interest on your mortgage!

Add in the option to deduct expenses you incur for maintaining the property and you have the option to reduce your overall tax rate, which is always a good thing.

Some examples of expenses you can deduct

- Labor for maintenance

- Materials for maintenance

- Depreciation

- Gas if you drive to buy maintenance materials

- Interest on you loan

There’s obviously a lot of tax benefits to owning property, which is why so many of the super wealthy people in this country own property.

Everyone wants to lower their income tax bracket, but that’s hard to do unless you own something. It can be property or a business, but if you don’t own anything it’s hard to make sizable deductions.

One way you can decrease your taxable income is by contributing more to your 401(k).

I’m not a tax expert (and you probably aren’t either) so you talk to your accountant to see what you could deduct.

Words of Caution

I still wouldn’t feel comfortable investing in a property without the ability to put at least 10% down.

You need to have enough savings left over to cover for vacancies and the inevitable maintenance costs that come with owning real estate.

Choose your property and the neighborhood you’re buying in carefully.

Neighborhoods that are mainly single family homes & commercial with a mix of multi-family properties are more attractive than neighborhoods with mainly renters.

Look at how the neighborhood is faring and how you think it will look in the future.

I’m all about holding real estate, so it’s important that neighborhoods I want to invest in continue to perform well into the future.

House hacking is all about reducing living expenses and if you splurge and can’t cover your payments you’re screwed.

Looking To The Future

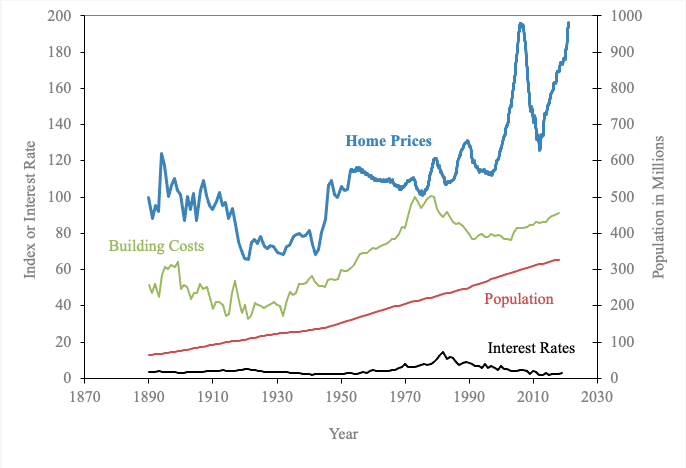

Interest rates are at historic lows and the housing market is hot.

This is seen all over the country, and many people including me are wondering if now is the right time to buy or if we’d be getting in at the peak.

I’m going to include the Case-Schiller index which I already referenced in my article on reducing living expenses.

Housing prices are at a high that hasn’t been seen since 2008. I don’t have to remind you what happened the last time they were this high.

The Case-Schiller index looks at United States housing prices relative to the real home prices in 1890 (the value of 100 on the left y-axis for home prices).

Right now home prices are at almost 200. The real question is if this value is justified or just reflecting another bubble.

Thankfully I’m not in the financial position to even make that decision right now, but it’s important to think about for those of you who are.

Are you thinking about investing in real estate soon? Do you think house hacking is a good idea now? Let me know in the comments.

Author Bio

Drake is a freelance writer who’s interested in history, economics, art, & beer. Drake graduated with a degree in Supply Chain Management and began working at General Motors. He writes about popular personal finance topics and shares his journey. Make sure to check back for more posts on Abnormal Money.

One thought on “Invest In Real Estate To Decrease Living Expenses”

Comments are closed.