Your money would be much better served working for you in a 401(k) instead of splurging excessively. Let your money work for you in a 401(k).

Hint: You can also reduce your income taxes!

There are some splurges that absolutely kill my budget, but it seems like I can’t avoid them!

I love hanging out with my friends and meeting new people. Usually the best way to do that is to grab a couple drinks and something to eat. Maybe compete in a trivia game while I’m at it.

But I feel worse for wear when I check my bank account at the end of the week. Going out a couple times a week can wreck havoc on your budget. I want to take a look at three commons ways we tend to blow our budgets.

Just a disclaimer, I’m not advocating that we stay inside all day and never see friends. It’s important to know how much we spend on activities and constantly assess if we’re doing too much or too little. The pandemic has shown us that moments we spend together are meaningful, so it’s important to still make time for friends and loved ones.

I think a lot of impulse purchases include food because it’s easy to justify that we need food immediately whenever we’re hungry. It’s not our fault the deli is right there with their enticing aromas floating out of their door. I’m getting hungry just thinking about it!

Buying Breakfast & Coffee

Believe me I’ve been there. You wake up late and roll out of bed and realize that there’s no time to fry eggs and brew a pot of coffee. So you opt to stop at Starbucks or Dunkin on the way to grab a latte and a bagel.

A medium coffee from Dunkin is about $2.00 plus a bagel with cream cheese for another $2.00.

On a good week you only treat yourself with breakfast and coffee to-go twice. That’s $8.00 a week and it could be more if you want to get a breakfast sandwich or a latte.

Ordering Lunch

Once it rolls around to about noon I always have that familiar feeling in my stomach. No it’s not nerves, I’m hungry! It’s so much easier to just order lunch at work than it is to prep and remember to bring a meal from home.

The downside to ordering lunch everyday is that it can get expensive pretty quickly. Let’s say with delivery fees your lunch you love to order everyday is $15. That’s an extra $75 per week on eating out!

A cheap lunch from home like a sandwich or leftover pasta would probably cost $0.50 per portion at most. Ordering lunch is the difference between $75 per week and $2.50 per week.

Going Out For Drinks

Let’s look at the price of a beer in the United States. You’re looking at an average of around $4.50. Depending on where you’re at in the United States that could be on the low or high end for a beer at your local bar, but we’ll use that as a good reference price.

The average price is 45 cents more in New York City than for the entire USA, so I feel comfortable using $4.50 as our average price of a drink.

Don’t forget to be responsible and use an Uber if you don’t have a designated driver! Uber X fares from Midtown Manhattan to Soho with light traffic is about $18 but can go up to $45 with heavy traffic.

In my experience an Uber usually costs around $20 for my trips where I live during peak times.

You’ll likely be out for drinks after work at the same time as everyone else, so bet on paying that peak hour surcharge. I’m assuming you’ll probably split an Uber with friends so that brings the cost down too.

This brings your total for a night out to about $30 with a tip. This could be higher or lower depending on how far your Uber is, how many people split the Ubers, and how much you drink, but this is still a hefty amount.

If you go out twice a week thats $60 total to grab drinks with your friends.

What’s The Damage?

Let’s combine our weekly expenditures we looked at above to see how much we’ll spend each week

- $8 for Breakfast/Coffee

- $50 for Lunch

- $60 for Drinks & Uber

Now we’re up to $118 per week on these splurges. That’s $472 per month, or $5,664 per year!

Either way this is a sizeable amount of money to spend on having fun. I’m not saying we shouldn’t have fun but there must be some other ways to have fun on a budget.

Investing In Your 401(k) Instead of Splurging?

One easy way to invest this money instead of spending it is in your 401(k).

Let’s say that you make $60,000 annually pre tax. It’s a good idea to plan to save at least 10% of your earned income.

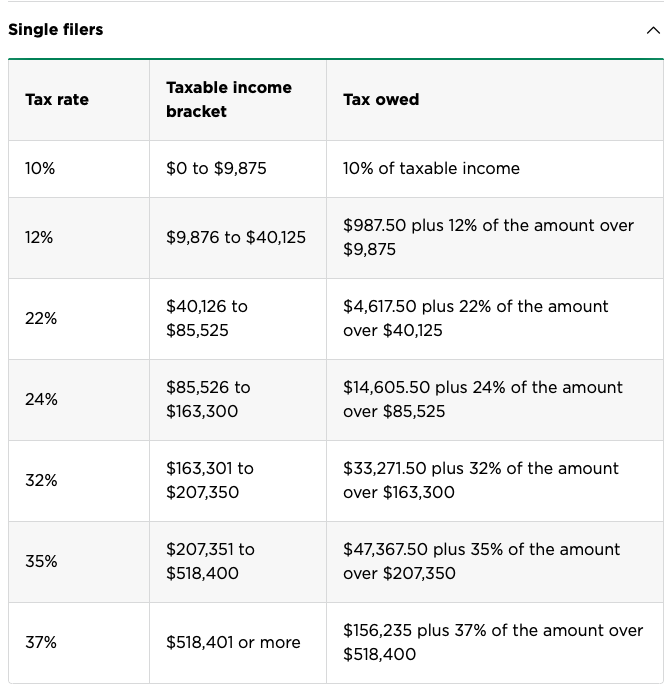

In this example that’s a minimum of $6,000 per year (that’s awfully close to the amount we could splurge every year). Looking at the table below, you would have about $20,000 taxed at 22%.

$6,000 is pretty far from the 401(k)’s maximum annual contribution limit of $19,500. But even if you just invest half of the estimated $17,184 into your 401(k) you’ll be much better off. 401(k)s are a great tool to start saving for retirement and reduce your taxable income at the same time.

401(k)s allow you to put pre-tax earned income into an account where it can grow and be taxed when you take it out starting at 59 1/2 years old. The advantage of the 401(k) is that it reduces your current taxable income.

If you invested about 10% into your 401(k) that would be $6,000. you would only have close to $14,000 taxed at 22% instead of almost $20,000. Thats the difference between $4,400 and $3,080 being taken out in federal income taxes. That’s just the federal income tax, expect to see more taken out if you live in a state or city with income tax.

I don’t know about you but I would much rather save $6,000 from being taxed and continue planning for financial success in retirement than go along without planning for my eventual early retirement.

Reducing my current income tax sounds great, but what if we looked at how much it can grow over time? We can assume an 8% long-term annual return in our 401(k). If we make consistent annual contributions of $6,000 to our account over 10, 20, or even 30 years the amount of money in that account will be a hefty sum.

How Your 401(k) Can Grow Over 10, 20, & 30 Years

Let’s look at your 401(k) growth if we assume an 8% return in your 401(k) and a contribution of 10% with a salary of $60,000.

After:

10 years you would have about $92,000.

20 years that grows into $296,000.

30 years your 401(k) will have a balance of $748,000!

This is all assuming no employer matching to your account. The power of compound interest is very real. It’s this opportunity makes me want to make sure I don’t splurge too much now.

If all I have to do is be a little bit more disciplined with my spending now in order to have a very comfortable nest egg in retirement, then I’ll do it without hesitation.

There is a debate on how much money you need in your retirement fund to comfortably withdraw in retirement, because inflation is very real and the power of one dollar will surely diminish over the next 30 years.

I like to allocate a 10% savings rate to a 401(k) because it’s fairly standard and hurts less than maxing out your 401(k) for people on a lower salary. The maximum annual contribution limit is currently $19,500.

The only problem is you need intense dedication to save this much pre-tax.

Plus you have to make sure you save at least 10% in post post-tax dollars.

Would you rather save more post-tax instead of pre-tax?

The more post-tax dollars you save, the sooner you will be able to buy real estate and diversify your income streams.

Regardless of how much you think you need in your account, there’s no doubt that saving pre-tax dollars in a 401(k) is a smart decision.

Let’s enjoy ourselves with our hard earned cash, but don’t forget to put some aside for retirement as well!

Author Bio

Drake is a freelance writer who’s interested in history, economics, art, & beer. Drake graduated with a degree in Supply Chain Management and began working at General Motors. He writes about popular personal finance topics and shares his journey. Make sure to check back for more posts on Abnormal Money.

One thought on “Invest In Your 401(k) Account Instead Of Splurging”

Comments are closed.