Right now, home prices and rent are as high as they’ve ever been.

For those of us looking to move to a new neighborhood or even a new city that is bad news.

We want to live in a nice place, but so does everyone else!

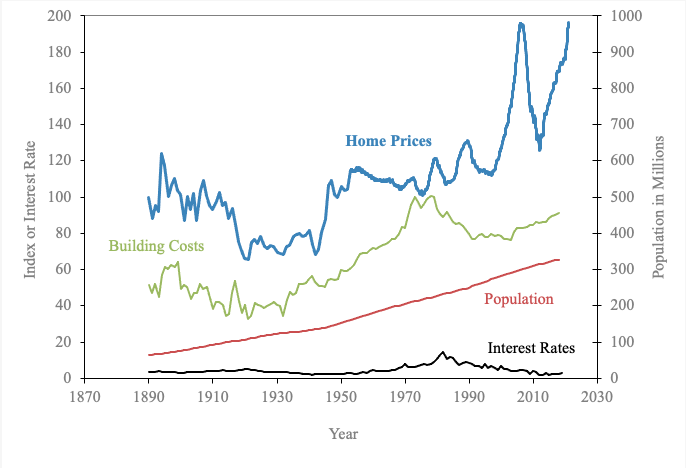

Look at this data from the Case-Schiller Index:

Just a bit of information on this index, it measures house prices related to the real price of homes in 1890 when the index was at 100.

This shows that the only time home prices have been as high as they are now just before the Great Recession.

I believe that the same trend can largely be seen with rents in most cities.

The version of the Case-Schiller index that is maintained by Standard & Poor showed that home prices increased 14.6% in April 2021.

I’m moving to a new city to start my job and I would love to keep my total rent costs (rent, utilities, parking, etc.) under 30% of my gross monthly salary.

I’m starting to see that it will be difficult to live in an area I want with a good commute.

Here’s a couple ways I’m trying to offset the higher prices of rents in the area where I’m moving

Buying used furniture

Facebook marketplace has been a great way to find good value used furniture for my new apartment.

I recently picked up a desk that is bigger than my current one plus a chair and a lamp for about $150!

I think the chair alone is worth that much. Try to look for deals on marketplace and be patient.

My advice is to look for someone selling who is buying more expensive furniture and just wants to get rid of what they currently have.

The person I bought mine from was turning his former office into a nursey for the baby he and his wife were expecting.

Look for people who are more concerned with getting rid of their pieces than trying to get the highest price.

Look for roommates

If you can manage living with roommates, then this is a great choice for lowering your rent.

I found a couple of people looking to rent out a room in their house or current apartment for about $800/room.

Be sure to take utilities, parking, and snow removal into account if applicable.

Another added benefit is most times the apartment or house you’re moving into is already furnished by the person who is already in the unit.

Not having to furnish your entire place could easily save you a couple grand.

Depending on how much you value having full control over your kitchen and other common spaces you might opt to spend a couple hundred more for your own place, but make sure to keep housing expenses under 30%.

Look for rent discounts

Some apartments offer discounts for employees of large employers like big corporations or hospitals.

Some of the more common ones I’ve found include waiving application fees and deposits!

A few have offered a small rent discount per month, around 5%.

It’s worth asking leasing agents if they offer any employer discounts, sometimes these are referred to as preferred employer lists.

Resist the urge for lifestyle creep

This is my first salaried job out of college, and it would be so nice to have something nice to reward myself for getting through college, wouldn’t it?

I could get a really nice genuine leather couch, or a nicer apartment in a more popular neighborhood, buy a new bike for cycling, etc.

Having a couple nice things is fine required that you plan for them, but once you stop living like a college student it will be difficult for you to go back to that cheaper lifestyle.

I want to make sure I save up a nice chunk of change for my savings and I’m still able to contribute to my 401k & Roth IRA.

I’d rather hit my contribution targets in those accounts than having a really fancy couch or going out to eat 4-5 times a week.

Final Words

Finding housing can be stressful and expensive, so make sure you stay on budget and still have money to save and invest after paying for your expenses.

The only feeling worse than being broke after paying your rent is knowing that you’re not saving for early retirement.

What other tips do you have for lowering your housing expenses?

Author Bio

Drake is a freelance writer who’s interested in history, economics, art, & beer. Drake graduated with a degree in Supply Chain Management and began working at General Motors. He writes about popular personal finance topics and shares his journey. Make sure to check back for more posts on Abnormal Money.

Very informative Drake!

Thank you! I’m glad you enjoyed it.

About how much money should I keep for emergency and should that be included or separate from my savings account?

A good rule of thumb is to aim for at least $1,000 in your emergency fund. I’d recommend keeping that amount in a separate account. After you get $1,000 its advisable that you save up to 3-6 months of expenses.

Thanks! Great info.