About

EveryDollar is an online budgeting tool owned by Dave Ramsey’s company. It aims to help users “meet your money goals–big or small”.

The main idea behind EveryDollar is that it uses Dave Ramsey’s preferred budgeting method of zero-based budgeting. In this method every dollar has a home, you don’t save 20% and then spend the rest on whatever you want.

Let’s get into the review.

Functionality

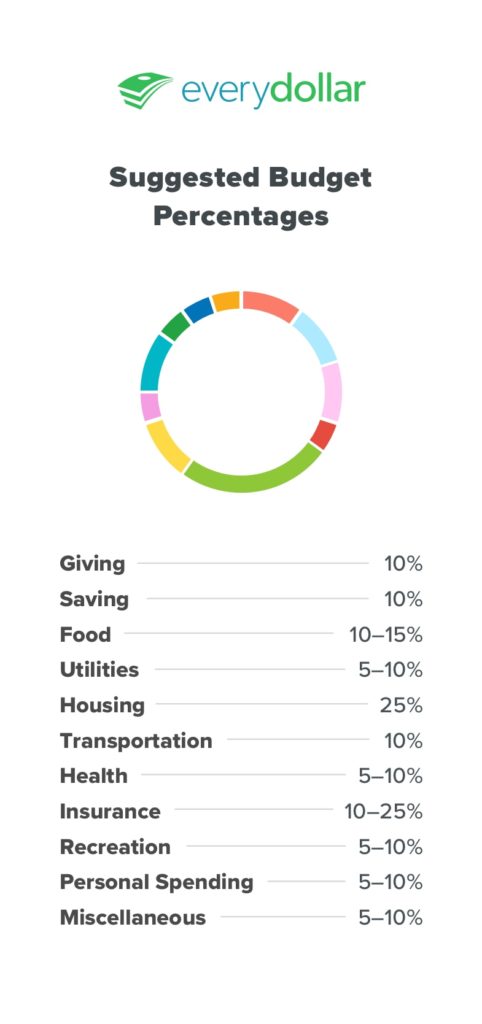

EveryDollar provides some guidelines for budgeting which are helpful, they also stress that these are just guidelines, and will differ based on users’ locations and situations.

It’s up to you if you want these percentages to be based on pre or post-tax income.

I would choose post-tax if you’re more of an aggressive saver, and pre-tax if you still want to save but at a lower rate.

I’ve found these percentages to generally be pretty helpful, but the housing is difficult to keep at 25% of my post-tax income in my area without a roommate.

Overall UX

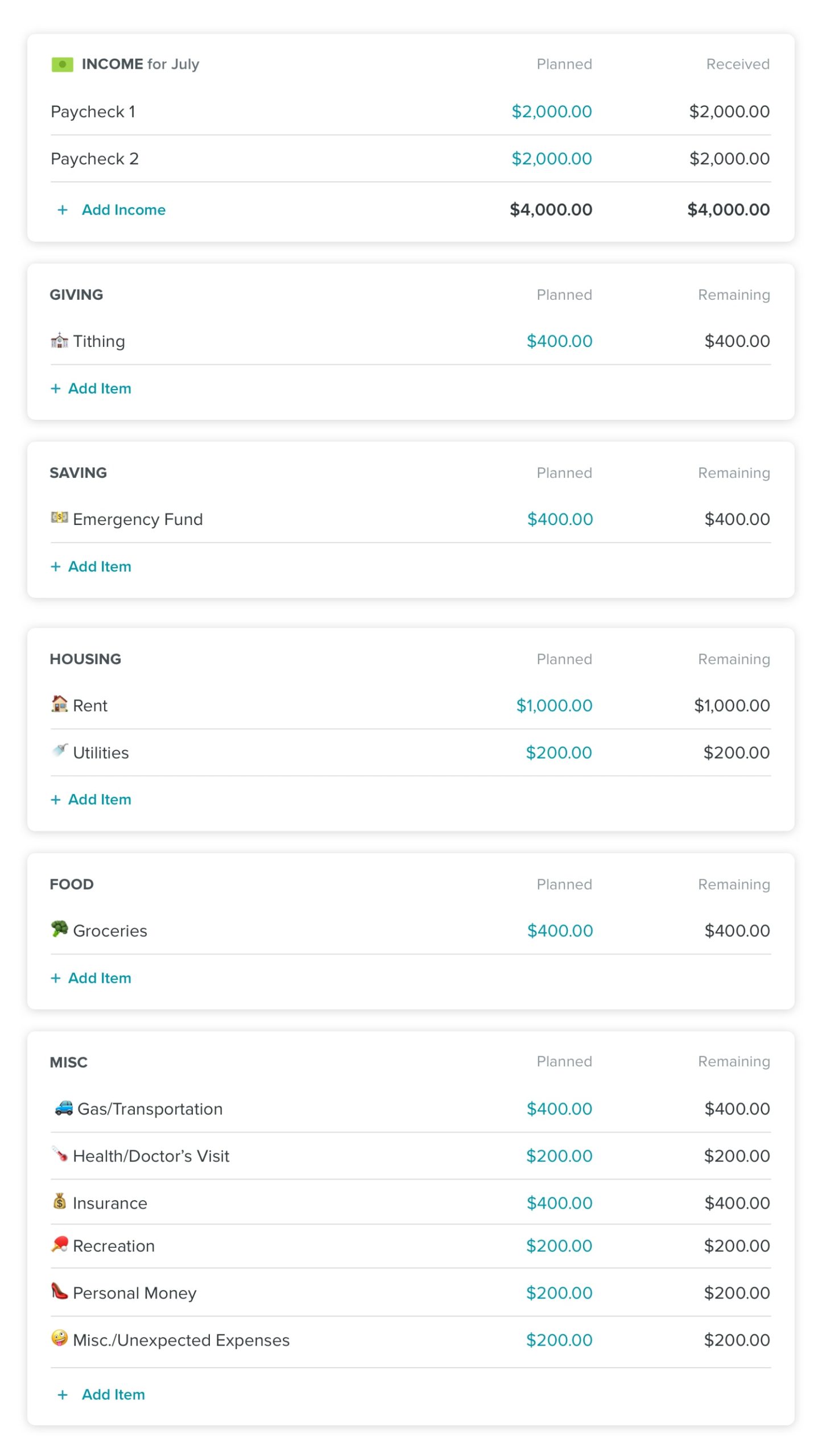

Here’s what the typical EveryDollar interface looks like:

It’s easy to set the budget for your categories. Then to actually track your spend you just add a transaction, either an expense or income.

You then assign it to a specific category and the app tracks how much more you have left to contribute.

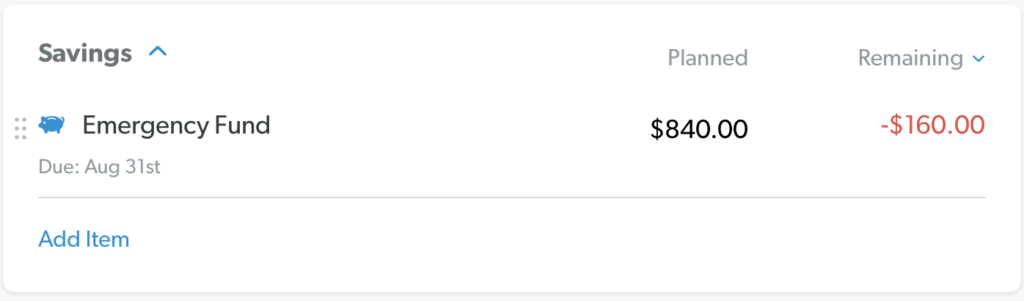

Here’s a screenshot from my EveryDollar account:

I planned to contribute $840 this month to my emergency fund, but I ended up making a little more money than I thought so I put $1,000 towards my fund.

That’s why the remaining balance is negative, I deposited $160 over my planned amount.

This works the same way if you spend more on a category than you planned for, like if you bought those shoes you want but didn’t budget for.

I would like for the categories in the app to be pre-loaded with these percentages, so when you add your monthly income the fields would auto-populate.

Then you could adjust the percentages based on your specific circumstances.

However, you have to determine your percentages and plan how much money you want to budget manually.

You do have the option to create and delete sub-categories which is nice.

Pros

- Customizable

- Budget guidelines are provided

- Categories are preloaded in app

- Easy to navigate

Cons

- Budget percentages are not assigned to categories

- Can be tedious to budget like this

Premium Features

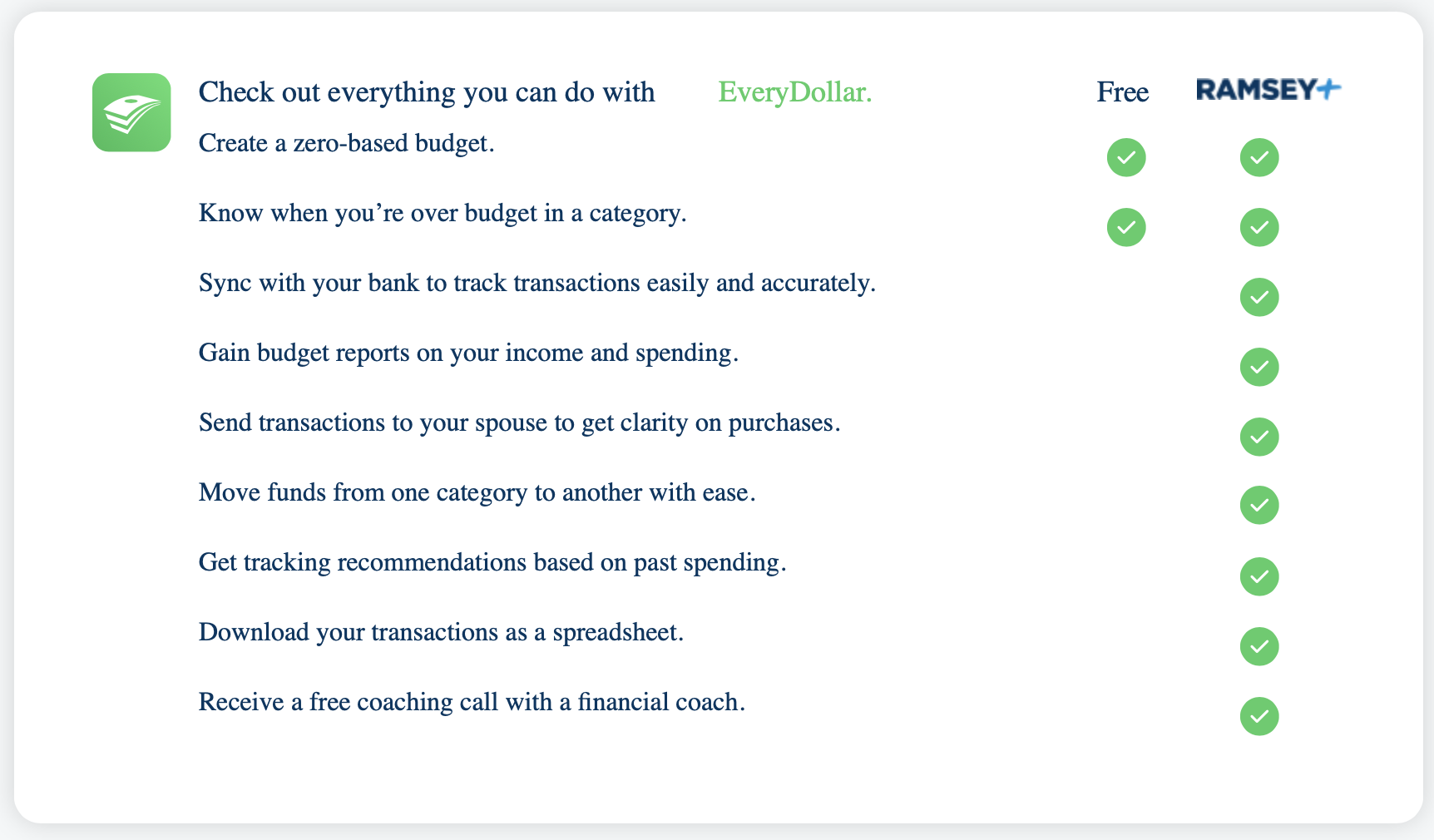

Some of the features that would really improve the user experience with this app are only accessible with the premium version called Ramsey+.

The ability to link EveryDollar to your bank account would be helpful so you don’t have to manually input your income and expenses into your daily budget.

You also have access to the insights page, which shows your budget progress over the months through visual graphs.

Finally, you also get access to online courses from Financial Peace University which is another one of Dave Ramsey’s programs to help people achieve financial independence.

12-month access to Ramsey+ is $129 but right now it’s on sale for $99.

Who Would Benefit From EveryDollar

EveryDollar is a great tool for people

- Who need a lot of structure to successfully budget

- Who have debt and want to pay it off fast

- Who don’t want to bother with budgeting in Excel or on paper

Are you planning on getting EveryDollar? Let me know in the comments!

Author Bio

Drake is a freelance writer who’s interested in history, economics, art, & beer. Drake graduated with a degree in Supply Chain Management and began working at General Motors. He writes about popular personal finance topics and shares his journey. Make sure to check back for more posts on Abnormal Money.